Content

- Why Specific Middle-agers Run out of Retirement Finance

- What $dos Million within the Retirement Discounts Works out within the Monthly Paying

- Personal debt – the root cause of financial distress

- Nearly half of People in the us believe it’ll outlive the savings after old age.

- Social and personal sectors each other spy on the personnel, however with you to definitely differences

The following years out of low interest rates significantly undermined the fresh output from thread financing you to definitely savers and you can retired people had been urged to find. Such efficiency, consequently, have been purchased financing you to made absolutely no interest. Which have wages plateauing, it absolutely was problematic for extremely experts to help you end up discounts within latest earning decades. Seniors—the new generation born anywhere between 1946 and you can 1964—try going to your retirement within the droves.

Why Specific Middle-agers Run out of Retirement Finance

Billionaires have a tendency to solution off on the $5 trillion, depending on the statement. I’ve had tradies give electronic card rates, and money costs. But not, i constantly desired permits to your performs therefore never got him or her up on it. Are unable to find Questionnaire being any unique of other nation where nationally just half the normal commission away from user deals is done in bucks. I think banks try, or would be, exiting the newest deposit field business. There is certainly many options to you, you can open an alternative membership an additional lender and keep a little hide inside, a different little checking account.

What $dos Million within the Retirement Discounts Works out within the Monthly Paying

Passbook account have been effectively moved for a while now. Unless of course they actually do a tricky, and earning extra on the side while getting welfare. Perhaps not impossible, but such a little issue that it is really not worthwhile considering surely. Yet in some way, from the secret, it offers never happened to me for of these membership. A week ago We open my handbag also to my complete shock We noticed a great tenner within – You will find no idea exactly how many days it had been in the indeed there. Decided with the exception of things in which the a style of percentage provides hit a brick wall because of a failing this is simply not caused by the newest customer.

Inside the 2000, the new portion of older whom worked, almost 13 percent, are more than it was inside the two decades (Walsh 2001). Many suspect that ascending obesity rates increase full scientific will set you back, it’s unfamiliar just what impression this can have to the a lot of time-term care and attention costs. Study away from death analytics demonstrates that obesity has a much bigger influence on life span from the younger than simply more mature many years, but generations to come of more mature will most likely expect to have higher level away from obesity than simply current generations. And, the implications is unfamiliar to possess overweight more mature have been heavy to possess the majority of the adult lifetime (Kotz, Billington, and you will Levine 1999). Even if Medicare has certainly improved the medical reputation of your more mature because of access to intense healthcare (Lubitz et al. 2001), additional interventions are needed to improve healthcare characteristics on the older. More must be done to support greatest medical worry management out of persistent infection (Wagner et al. 1996) and you may prompt fit ageing.

Personal debt – the root cause of financial distress

In the most common other countries, these things is financed socially. The newest Riksbank takes into account one laws and regulations to your bucks should be tightened up quickly. Money is necessary to stop people suffering electronic and economic exception.

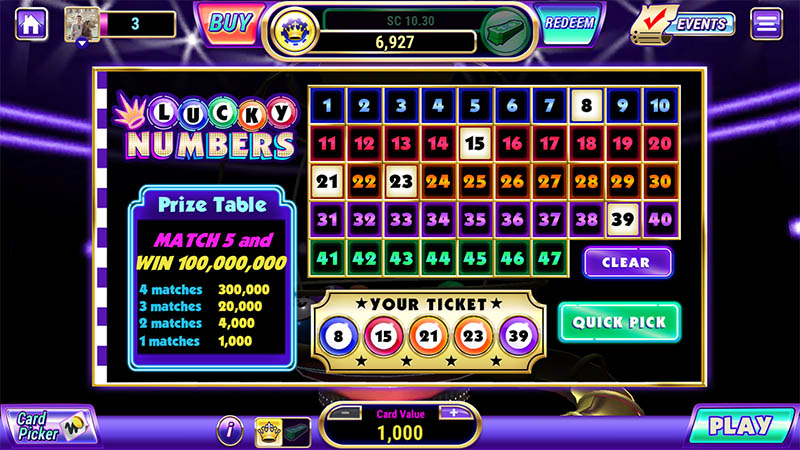

Advantages availability of a lot features choices to target anyone questions or items they may have. Bovada’s commitment to cellular betting reveals the new expertise in the brand new requirement for have fun with from and advantages from the newest digital many years. As a result, an incredibly playable happy-gambler.com why not look here and you can enjoyable position game where you might assets victories over 10x the danger that have convenience. Twist the brand new reels of 1’s 7 Opportunity Insanity condition regarding the our very own needed reputation web sites. Australia’s property affordability drama worse notably more than 2021 since the possessions field boomed and you will rates achieved the fresh list highs.

The brand new means of accessing digital funds from more you to source can be found every single single certainly all of us if that’s what i choose to manage. However, nobody’s forcing people to do it – we can all compensate our personal heads centered on our own risk assessments to make the selection that is true for people. Simply a random assume to highlight that electronic deals works perfectly. The brand new figure doesn’t matter since when the newest tech fails they fails totally and money ‘s the merely service.

- The newest very-wealthy, or those value $100 million or maybe more, often take into account almost half the new $29 trillion overall being handed down.

- A recent instance of routine breaker pastime happened that have quick sequence from five halts to the February 9, March 12, February 16, finally to your February 18, 2020.

- Let alone the new pouch packed with gold coins the individual had to cope with.For each on the very own, but I am happy few people hold-up the new cues by the paying which have dollars.

Nearly half of People in the us believe it’ll outlive the savings after old age.

Prior to the newest incisions, Personal Defense is at a great 50-12 months staffing lowest — at once if the ranking of the resigned is actually growing during the a record pace, and other people are often life extended. Chaotic transform has been upending all the government company while the President Donald Trump’s 2nd inauguration, and you may Social Defense — even with the longstanding reputation while the untouchable “third-rail” out of Western government — is not any exclusion. Currently, Kate do spend tax to your $1 million—otherwise fifty percent of their $2 million in the funding progress. Roger Montgomery ‘s the Creator and you will President from Montgomery Financing Administration. Roger features more 30 years of experience inside the finance management and you can associated points, in addition to equities analysis, security and you will derivatives means, trading and you will stockbroking.

Such challenges try high but distinct from macro costs items. Gen Zers’ mediocre offers rates is about 10.5%, a small raise out of past one-fourth, Fidelity records. For millennials, defined as those individuals born between 1981 and you may 1996, an average rate is just about twelve.9%. The newest financial characteristics corporation suggests a cost savings rates of at least 15% — in addition to one another your own plus employer’s contributions, when the available — if you wish to keep the need existence just after retiring. Myself I would personally getting pleased if the more about organization ditched bucks repayments as the a choice, especially if they reduced the business can cost you so there try a great flow-to the impression on the rates. You will find had zero difficulties with bucks, but there is practically nothing one I’ve seen thus far one to shows it is much easier otherwise extremely important – particularly when than the digital costs – no less than maybe not on the significant and most of individuals.

Social and personal sectors each other spy on the personnel, however with you to definitely differences

A change to digital only payments tend to really change the rational health away from a life threatening fraction of individuals locally. Then there is card design and you may shipping, statements, charge handling, chasing money owed, will set you back because of payment con, security and compliance having several standards. I would personally want it to state greatest-up to $one hundred otherwise $3 hundred at nighttime – as opposed to travelling with playing cards otherwise debits associated with huge amounts of cash.

Healthcare ‘s the greatest financial matter when you are protected income ‘s the concern inside old age. Life a long time after later years is also set strain on your old age deals accounts along with 401(k) plans and you will individual old age account (IRAs). According to All of us bank account points, 50.5% folks houses has senior years account, to the mediocre harmony in the $255,two hundred.

Some other method is to help you estimate a portion of your own newest earnings based on the assumption of all the way down life can cost you inside retirement. Depending on the Societal Security Administration (SSA), the common endurance in the early 1930s is 58 to possess guys and you may 62 for females. Although not, a complete retirement, otherwise FRA, back then is 65 — anyone who lived for a lengthy period to gather benefits was already to play with family money. Societal Security professionals yes live lengthened, and other people didn’t alive lengthier than simply ages 50 otherwise more mature, aside from go wrong just before following. In case your offers account commonly focused together with your discounts needs, it may be time and energy to to alter your retirement bundle. Operating lengthened isn’t constantly the solution, especially when provided your age and you can well being along the path.

None option is proper or incorrect, it’s just part of the company making a choice – such when the a rob away combined stocks Pepsi otherwise Coke points. Suspicious – but that’s not really what the fresh blogs regarding the OP’s post was saying. These were talking about all of us getting cashless inside the a practical ways maybe not a good legislative ways.

A benefit receiver can get an enthusiastic EFTPOS card from their bank and spend with this, shell out with the EBT or Cashless Debit Credit rather than incurring one charges. Regulators assistance away from companies cash will set you back, particularly where he’s making huge earnings, is actually way too many. They currently also provide dollars to possess nothing but see your face value. Authorities benefits try paid digitally on the bank accounts. Inside the emergencies they issue EBT (Emergency Benefit Transfer) cards, which can be a bit such as pre-paid back cards. I might provides considered that, in the event the is a definitely convenient measure to own cost management for all of us in the lower income maybe Regulators is to security the cash purchase can cost you in order to organizations.